Online Travel Agencies (OTA) like Booking.com, Expedia, and Skyscanner are on the frontlines in the fight against eCommerce fraud. Why? Well, frankly, there’s a high resale value for airline ticketing and hotel bookings and an absence (most of the time) of physical goods, making the industry a prime target for fraudsters.

But there are ways to win the battle against bad actors! In this post, we’ll explore some of the fraud types that OTAs face, how to detect fraud, and a few tips for OTAs and their customers.

What Is Online Travel Fraud?

Spoiler alert: online travel fraud isn’t much different than any other eCommerce or online payment fraud type. However, the online travel agency vertical is more highly targeted than other industries. That’s because of the high resale value for airline tickets, hotel room bookings, packaged getaways, and excursion bookings. Who doesn’t love the beach? Or the idea of a four-night cruise with a little excursion built in? Fraudsters know it’s an easy sell.

And the types of fraud that bad actors use will likely be very familiar to online merchants, fraud victims, and even fraud prevention companies everywhere:

Fake or Stolen Payment Cards

Fraudsters use stolen credit card numbers and personal identifying information to attack people and companies daily across the globe. According to the National Council on Identity Theft Protection, fraud cases are up 70% from 2020, accounting for $392M in losses from online consumer shopping.

Chargeback Fraud

Chargeback fraud happens when online shoppers abuse the chargeback process intentionally. Regarding online travel agencies, a bad actor might purchase a flight, take the flight, and then initiate a chargeback afterward, where the goal is to get free travel. Of course, travel isn’t free—the OTA would pay the bill if the chargeback is successful.

Account Takeover

Account takeover (ATO) fraud is rampant in the travel industry. Fraudsters send emails or text messages posing as an OTA. A link is usually included in the email or text, and when an unsuspecting customer clicks or taps to open the link, they’re taken to a fake website that’s designed to capture their login credentials.

Ticket Cancellation

And then there’s ticket cancellation fraud. This happens when fraudsters book a flight or hotel with stolen credit card numbers and then receive the airline bonus points, and rewards points, which fraudsters can use to purchase more tickets or resell for profit.

Preventing Travel Fraud for OTAs and Customers

Now that you know the types of online travel fraud targeting OTAs, let’s look at how travel booking sites can prevent fraudulent attacks on their business. We’ll also explore tips for travel customers to protect themselves from bad actors.

How Can OTAs Help Prevent Online Travel Fraud?

There are two main solution categories that OTAs should focus on to prevent travel booking and ticketing fraud attacks:

- Identity verification - As we mentioned in our blog post, 6 types of ecommerce fraud and how to prevent them from harming your customers, uniquely identifying malicious visitors and related patterns of fraudulent activity, ecommerce store owners can take proactive measures to reduce the risk of compromise. This still holds true and partnering with a company like Fingerprint can help you identify users with industry-leading accuracy using browser fingerprinting that identifies unique and anonymous users!

- Fraud prevention - Once you know who is visits your site, you can rely on your fraud prevention solution provider to employ powerful technologies that detect and prevent online payment fraud.

What Can Travel Customers Do to Help?

Customers booking travel need to ensure that they’re booking from a legitimate OTA. Let’s explore just a few tips and some questions that customers should ask themselves.

- Use two or three really well-known OTAs as your point of reference. For example, if Booking.com or Expedia have price ranges in the same ballpark, you can safely assume that you should expect to pay (approximately, at least) those prices.

- Did you arrive at this travel website through a link you clicked in email or text? If so, be absolutely sure that the email or text came from a legitimate OTA. Why? Many times, fraudsters will re-create a website to look like an authentic, travel booking site, but the goal is to steal your payment card details and/or account information!

- Read the reviews on Google, Tripadvisor, or another reputable review website for travel. Trusted review websites are a solid tool for travelers to be sure they’re not only reserving a good hotel room but that other travelers can vouch for the experience of getting what they paid for.

Leading companies like Vesta can provide OTAs with a fraud prevention platform that employs machine learning, artificial intelligence, and graph analysis that uncovers fraud patterns and even takes on the risk of fraud.

Apart from these two solutions, OTAs can take additional steps to mitigate fraud losses, such as manual reviews, custom rules, adding a blocklist, and good old-fashioned KYC.

Reputable OTAs have a good amount of data on their travelers. Tapping into that data to prevent fraud is good. Pairing that data with a top identity verification company and fraud prevention solution is even better!

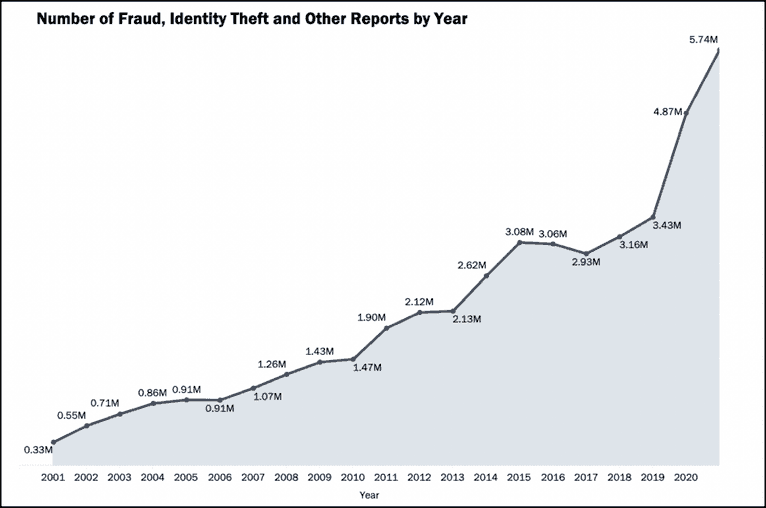

Staggering Statistics for Identity Theft

Credit card fraud is the most common type of identity theft. According to the latest Federal Trade Commission report, “identity thieves access a registered credit card of a victim or manipulate people into sending them money.”

The most common types of identity theft are account takeover, fraudulent new account openings, and informational theft for financial gains. Unfortunately, these methods are used in online travel fraud, making it vitally important for OTAs and their customers to remain vigilant when booking travel online.

Originally published at https://www.identitytheft.org/statistics/

Originally published at https://www.identitytheft.org/statistics/

Conclusion and Next Steps

It’s important to remember that fighting fraud is a never-ending battle that requires companies and customers alike to act quickly. Customers should use or make a fraud awareness checklist when booking travel online. Merchants and OTAs should ensure they’re leveraging high-value partnerships with specialist providers in the identity verification and fraud detection space that go above and beyond built-in capabilities from payment providers.

To learn more about why Fingerprint is the best choice, give us a test drive today—it’s free for fourteen days with unlimited API calls. We’re your trusted partner in identity verification as a fraud prevention tool.

And you can solidify your solution set even more when you add Vesta’s Payment Guarantee to your fraud-prevention arsenal. With Payment Guarantee, you’ll never pay for a chargeback again—whether your customers are booking travel or just shopping online!

Safe and happy travels from your fraud-fighting friends, Fingerprint and Vesta.